When customers are unable to pay their outstanding debts, it can create challenges for businesses trying to maintain accurate financial records. One way to handle bad debts is to use the payment allocation window in iDempiere ERP. Simply create a new charge for the bad debt expense, write it off using the payment allocation window,…

Description

In the business world, it is not uncommon to encounter situations where customers are unable to pay their outstanding debts due to financial difficulties or bankruptcy. This can result in bad debts, which can create challenges for businesses trying to balance their books and maintain accurate financial records. However, there is an easy way to write off bad debts using the payment allocation window in iDempiere ERP.

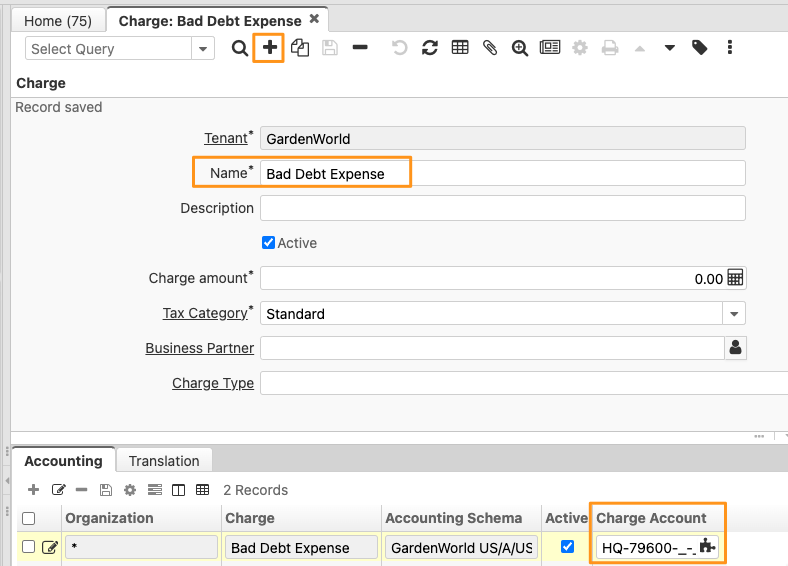

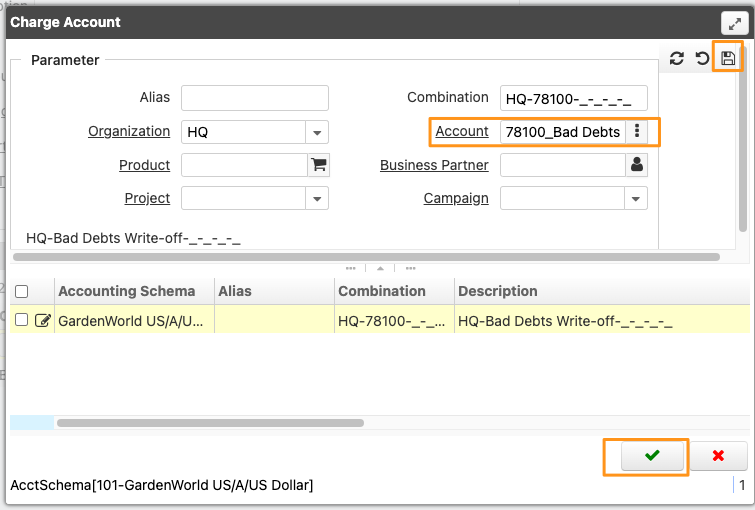

To begin, create a new charge for the Bad Debt Expense. This charge will be used to record the bad debt expense in your financial records. Once the charge has been created, you can write off the bad debt by allocating the outstanding balance to the Bad Debt Expense charge.

Create a new charge for the Bad Debt Expense

When a customer is unable to pay their outstanding debts, businesses may need to write off the bad debt as a loss. To properly account for this, businesses can create a new charge for the bad debt expense in their accounting system. This charge will serve as a record of the loss and can be used to track the amount of bad debt written off over time. By creating a new charge for the bad debt expense, businesses can ensure that their financial records accurately reflect the impact of bad debts on their bottom line.

First, we create a new charge in the Charge window.

This is very important. Remember to set up accounting for the charge.

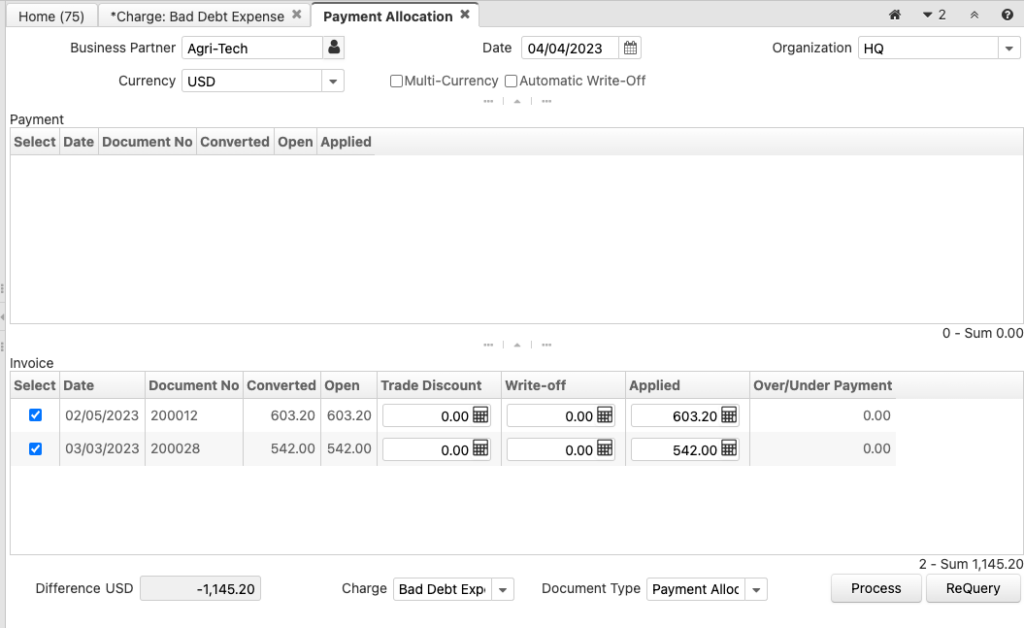

Payment Allocation

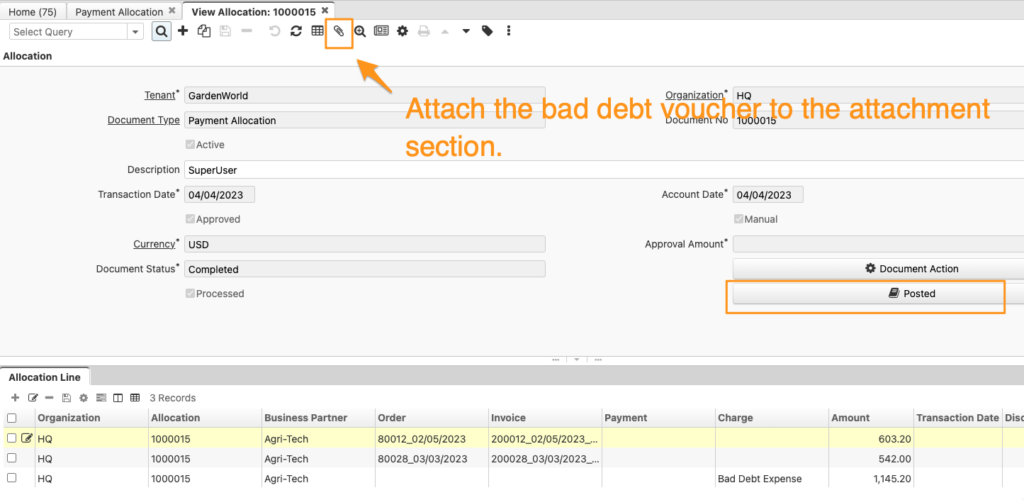

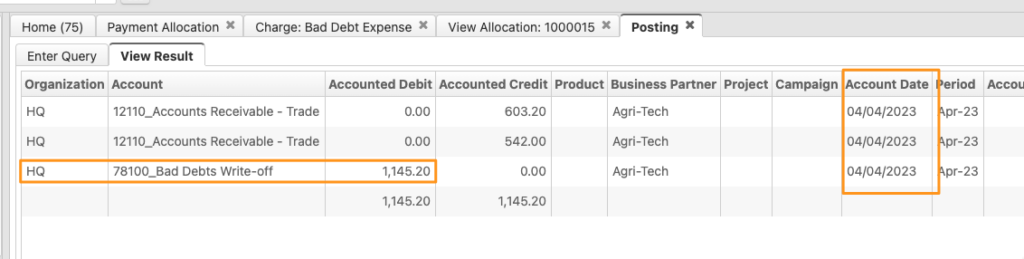

Once the new charge has been created, you can proceed to write off the customer’s outstanding receivables. To do this, open the payment allocation window in iDempiere ERP and select the corresponding invoice or receivable in the payment allocation window and allocate the payment to the newly created bad debt expense charge. This will reduce the customer’s accounts receivable balance and increase the balance in the bad debt expense.

It’s important to note that before writing off bad debt, you should first confirm that the customer’s account status has been changed to “bad debt” or “uncollectible” to ensure that the bad debt is being handled correctly. Additionally, seeking the advice of a professional accountant or financial advisor can help ensure that you’re following best practices and staying compliant with accounting standards and regulations.

In summary, it is possible to use the payment allocation window to handle bad debts as well. By creating a new charge for the bad debt expense and allocating payments to this charge in the payment allocation window, you can ensure that your financial records are accurate and up-to-date even in the face of bad debts caused by customer bankruptcy or financial difficulties.